Here at acasa, our goal is to solve the problems related to when you split the bills with the people you live with. In order to test this experience in action, there was no better method than to spend a week living and working together as a team in Morocco. We decided to track all of our split bills both big and small for the week. In just 5 days we shared a wide variety of expenses. There were living and transportation costs, food and drink costs, Jet Skiing and quad biking and even 35 pence to use the toilet. We wanted to experience together the many little nuances of sharing finances.

In this post, we want to showcase exactly how things played out as we continuously split the bills throughout the week. One important concept to note is that at acasa, we promote the concept of paying it forward. By giving a little, you end up getting a little 😉 This is defined as:

- If you paid for the last thing and are in ‘the Red’, it’s your turn to “pay it forward” and pay for the next thing for your home e.g. toilet paper

- If you bought the milk last time and are in ‘the Green’, one of the people you live with should pay for the next thing

Paying it forward is similar to buying rounds so friends groups are usually well versed in this mentality. acasa allows you to apply this thinking to larger more complicated spending situations. On our team we found that it felt like an honour, and quite a relief, to pay it forward and try to get yourself far into the green. Once in credit, you could relax in the joy of having it feel like others are just buying things for you for the next few items and meals on the trip! Obviously in reality, you ponied up big early on – but it feels good to sit pretty in that green.

Morocco proved the ideal testing ground for us to use the pay it forward mentality in action as we split all the bills.

Here is how it played out:

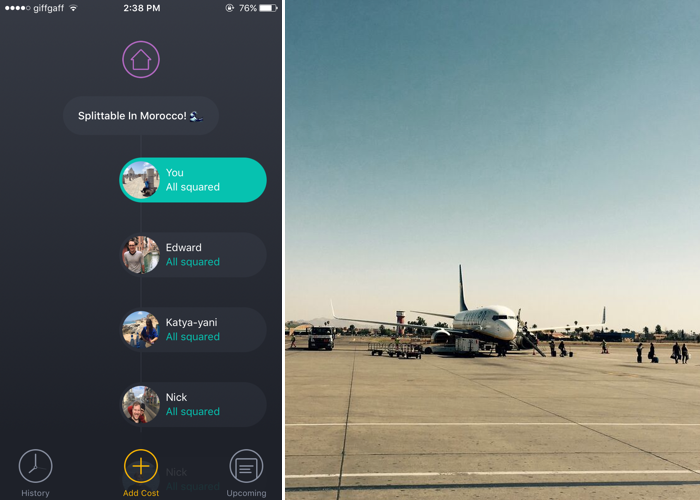

It was happy beginnings as everyone started out ‘all squared.’ This meant that everyone was on a balance of zero as we had not split any costs yet.

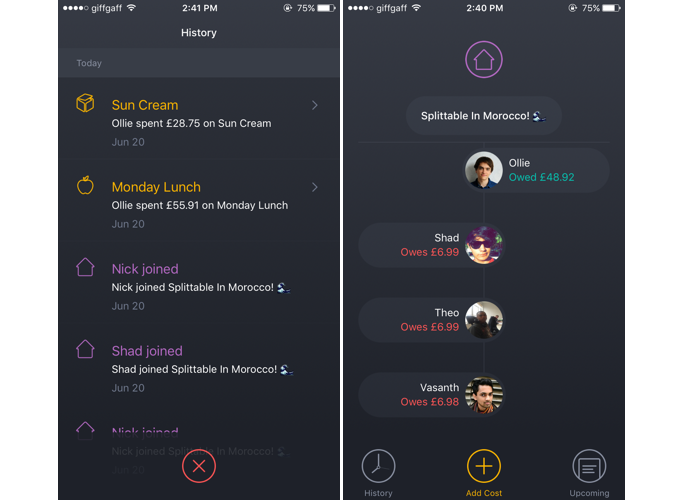

One of our developers, Ollie, with his trademark organisation, planned to take out Moroccan Dirham ahead of time and this meant he was paying for pretty much everything until we found a cash machine. As a result, he shot into the green in the first hours of the trip as he purchased the Monday lunch & suncream.

Finding a cash machine proved to be a challenge. In our small surfing village there simply weren’t any. We had to negotiate a 15 minute taxi ride to a neighboring beach town in order to take out Moroccan Dirham.

Morocco is primarily a cash based society and very few establishments (that we found) accepted payments by card. We were shocked by this with our London ‘contactless payments’ mentality. The second time we visited this ATM after taking out 1000 Dirham (£74), the ATM reported it was out of cash.

Suncream was needed…

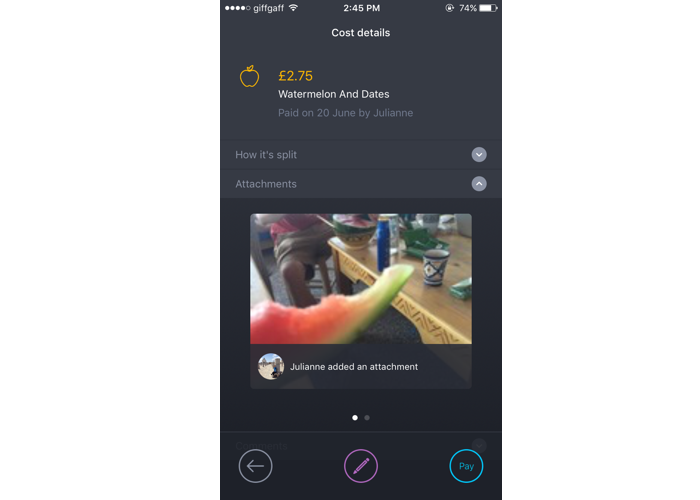

Wanting an afternoon snack, we splurged £2.75 on a watermelon and dates. When trying to evenly split the bills, remember that even the small shared expenses can add up…

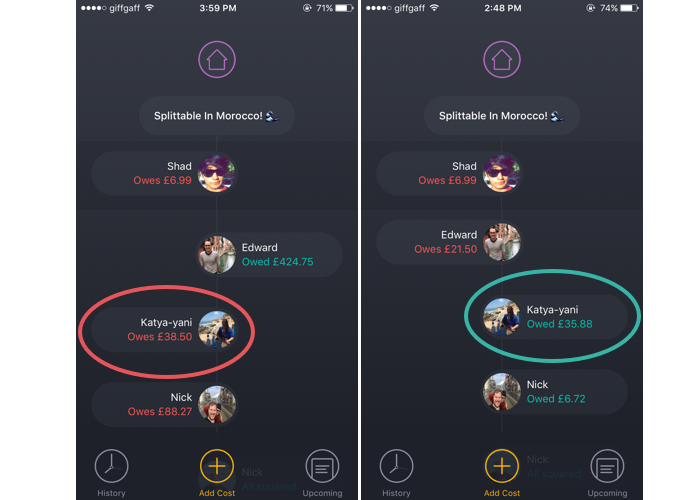

Katya was then able to even out her debt by footing the dinner bill for the whole squad. (£58.18) Here you can see how she moves out of debt into the green while the rest of us owe more.

If you haven’t tried it, Moroccan food is pretty delicious!

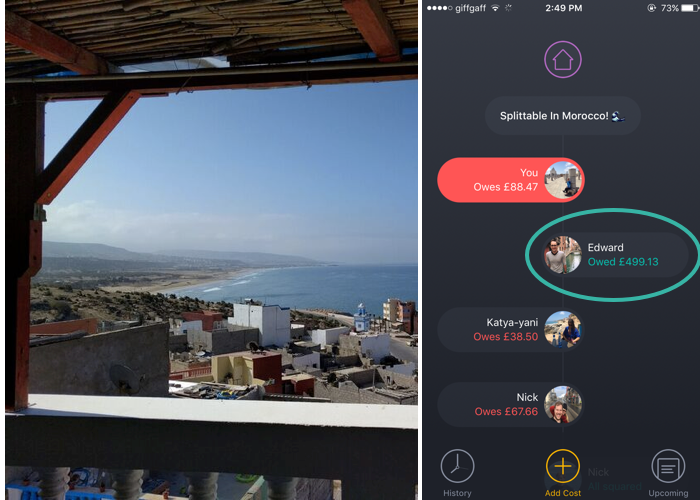

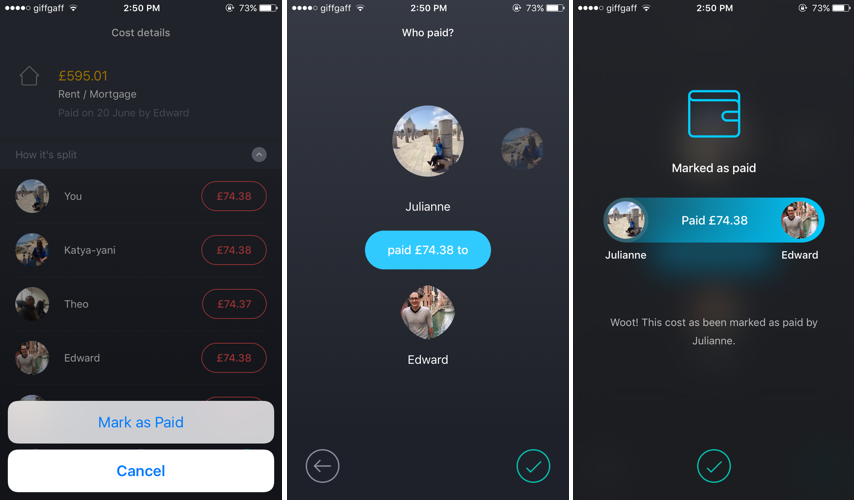

When Edward spent £595.01 for our accommodation and airport van, he requested that that everyone immediately reimburse him as this was a large cost.

You can see that even though Edward paid £595.01 he only became £499.13 in credit as this payment was evening out his debt.

The image on the left is the view from our office/home for the week. We were staying in a co-working and co-living space called SunDesk. #homesweethome 😉

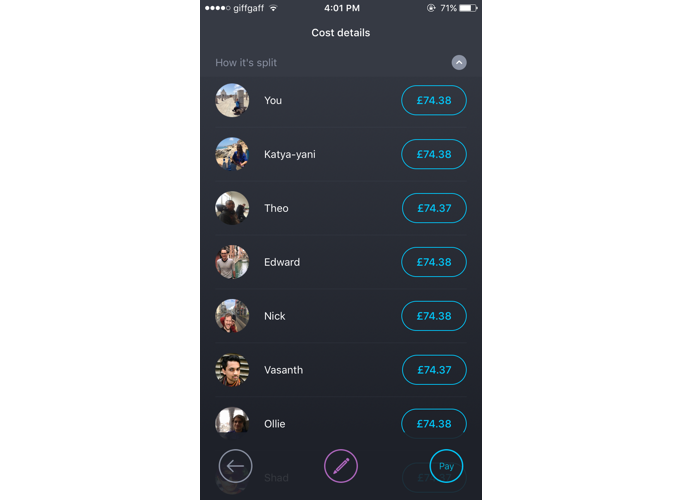

Everyone quickly paid Edward back for that large cost.

Once a cost is paid back, that expense is marked as blue on the cost details page. Here you can see that everyone had paid Edward back.

An extra night in Marrakesh:

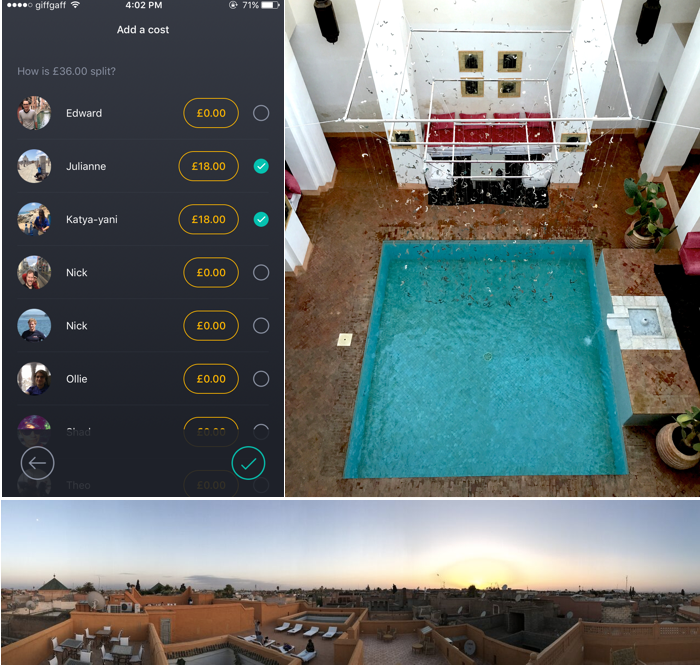

6 of us decided to spend an extra night in Marrakech before heading back to London. We split into pairs to share rooms at a Riad in the center of Marrakech for a mere £18 each.

I shared a room with Katya. Since we were the only ones on this cost, we only split the cost two ways by only selecting our two names.

£18 goes a long way in Morocco. The photos above are from our hotel’s beautiful pool and roof terrace.

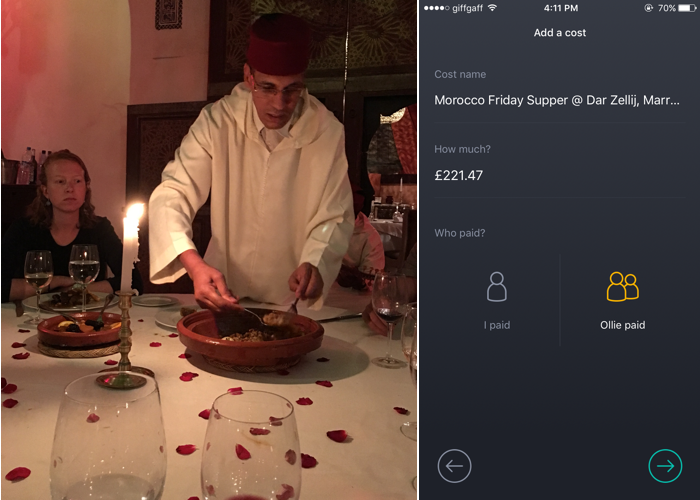

Finally, we celebrated our final shared meal with a bit of luxury. We dined at the famous Dar Zellij restaurant in Marrakech. They served us the most delicious lamb, beef and veggie tagines that any of us had ever tried.

At the end of the trip, it was clear who still needed to settle their debts and pay others back. Only slightly sun-burned, we all returned to London energised. As a company we had truly shared costs while living together. We had to learn how to split the bills not only with the people we were living with, but the people we work with as well.

Learning how to split the bills can be an extremely stressful experience in a multitude of settings particularly in the place you live. acasa was able to help us manage our finances when we lived together and we hope that is can do the same for shared households around the world.

Want to try acasa or yourself? Download here: http://spli.tt/morocco